After home prices nationwide reached historic highs in recent months, rising mortgage rates have applied some much-needed pressure to the hot housing market. However, since mortgage rates have started to fall in recent weeks, many analysts are divided on whether home values will crash or continue to decrease slowly until 2023.

Because people who bought homes in previous years at incredibly low mortgage rates are continuing to live in them, the overall supply of housing in the country is still constrained. Due to the limited supply, prices have not dropped further, keeping homes out of reach for many people, particularly first-time purchasers.

Home prices are still high year over year, although not as shockingly so as they were earlier this year. The direction that mortgage rates go will probably determine how much home prices fall in 2023.

If Prices Decline, Sales Could Stagnate

Consider that you wish to buy a house and that local real estate values are declining. You may feel tempted to hold off. After all, why purchase a home now if you anticipate being able to purchase a home comparable to it for less in a few months? Most likely, under such problem conditions, a guaranteed $200 loan may be needed to cover various unforeseen expenses.

This unflinching reasoning has the drawback that you cannot forecast when prices will reach their lowest point. If you wait too long to make a purchase, prices will increase and there will be more competition. It is not wise to use this tactic, known as market timing.

If you can discover a new home with a monthly payment that fits your budget and the market is favorable for you to purchase, go ahead and do it.

And if you wait for prices to drop but they never do, you can learn the hard way that the house you truly loved and could afford but passed on last year is now more costly the following year.

Given the nature of human nature, you will probably still attempt to time the market.

There Are More Homes for Sale, but There Are Still not Many Available

In recent years, a shortage of houses has fueled heated competition among buyers. However, when summer began, the supply improved.

In June, there were 9.6% more homes for sale nationwide than in May, according to the National Association of Realtors. This increased the supply from 2.6 months in May to three months in June, compared to 2.5 months in June 2021.

A three-month supply indicates that, at the present sales rate, it would take three months to sell every home. Sales of newly constructed single-family homes decreased 17.6% year over year and by an upwardly revised 10.9 percent to 603,000 units in September.

Home Listings Are Remaining Up for Longer

A further indication that prices may continue to decline is the increase in the number of properties for sale as demand declines.

Property listings are continuing and becoming distinctly stale. Listings increased by around 33.5% in October compared to the same month last year, adding nearly 189,000 more houses to the available inventory on any given day.

Due to the fact that the market’s peak has passed and sellers are no longer motivated to post their properties for sale, the number of new listings has decreased by 15.9% year over year.

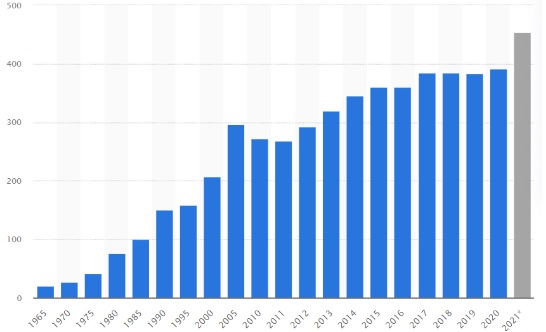

This fall, intrepid buyers who do submit an offer do it slowly, maybe in the hopes that sellers would keep lowering their prices. The price of homes in the United States increased in 2020 and 2021 after reaching a plateau between 2017 and 2019. 2020 had a 391,900 dollar average sales price for new homes, while 2021 saw a 453,700 dollar average sales price.

How to Lower the Asking Price of a House

Here are a few strategies for negotiating a home’s list price so that you may leave with a discount.

Making Use of Your Real Estate Agent

Your real estate agent is not only familiar with negotiating lingo, but also intimately familiar with your local market. Let them aid you in creating a compelling house offer. After all, they are aware of the lowest offer you may make before the seller loses interest.

Obtain a Detailed House Inspection

The most frequent cause of a home selling for less than the asking price is a serious issue with the property. But unless you get a thorough home inspection, you won’t know if the house has any issues.

Provide a Letter of Preapproval

Preapproval and prequalification are two distinct processes. Before you even started looking for a home, your lender most likely provided you with a pre-qualification letter.

The particular mortgage amount that your lender believes you qualify for is stated in a preapproval letter. A pre-approval letter makes an offer significantly less likely to be rejected by the seller. If the seller is aware that your financing is solid, they could agree to a reduced asking price.

Find Out How Long the House Has Been for Sale

Depending on the market, if a house has been on the market for longer than usual, it can be because the asking price is too high.

Conclusion

In any market, purchasing a home is a very individualized choice. The majority of people’s lifetime purchases will be at home, making it important to be financially stable before making a commitment.

To determine your monthly housing costs depending on your down payment and interest rate, use a mortgage calculator.

The greatest approach to buying a property is not to try to foresee what could occur in the upcoming year. Buyers who wait to purchase today in the hope of later price reductions risk being let down.